Medicare Health Insurance

One of the most important things to know about Medicare is that TIMING IS VERY IMPORTANT. Because of the many and varied issues around timing, you should call our office for accurate advice about when to apply.

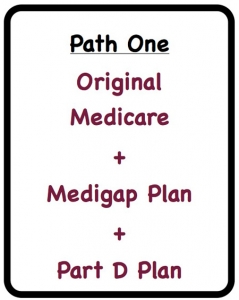

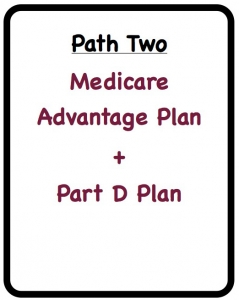

There are two paths to comprehensive coverage once you are Medicare eligible. The first includes a combination of Original Medicare, plus a Medicare Supplement and a Medicare Prescription Drug plan. The second involves exchanging Original Medicare for a Medicare Advantage Plan.

Path One

Original Medicare is the health coverage you get when you turn 65, or at any age if you have certain disabilities. It is also available to people with permanent kidney failure requiring dialysis or a kidney transplant. You must be a US citizen or a permanent resident of the United States to be eligible for Medicare.

Original Medicare is the health coverage you get when you turn 65, or at any age if you have certain disabilities. It is also available to people with permanent kidney failure requiring dialysis or a kidney transplant. You must be a US citizen or a permanent resident of the United States to be eligible for Medicare.

Original Medicare has two building blocks: Part A and Part B. They are the foundations of Original Medicare.

Part A or Hospital Insurance

- Provides coverage for inpatient care including Inpatient Hospitalization, Skilled Nursing Care and Hospice Care

- Has a deductible, or amount you have to pay, every benefit period. A benefit period begins on the first day you receive inpatient hospital service and ends after you have been out of the hospital and not received skilled care in any other facility for 60 days. The deductible usually increases annually.

Part B or Medical Insurance

- Medicare Part B covers medical expenses in or out of the hospital and outpatient hospital treatment as well as physician services, inpatient and outpatient surgical services and supplies, diagnostic tests, and durable medical equipment.

- Has a deductible which may change annually. There is also Medicare Part B coinsurance of 20%. For example, a diagnostic test for which Medicare approved a $1000 charge would be split between Medicare and you. Medicare would pay $800 and you would pay $200. This split occurs for every covered service under Medicare Part B after you’ve met the deductible.

Many Medicare beneficiaries find the Medicare deductibles and coinsurance unacceptable and choose to supplement their Original Medicare coverage with a Medigap plan to have more comprehensive coverage.

Medigap Options

The terms Medigap and Medicare Supplement are used interchangeably. There are ten standardized Medigap plans. PLAN A covers only basic care. Because PLAN F is the most comprehensive, it is the best option if you are trying to close the gaps of Original Medicare. PLANS K, L, M, and N charge either coinsurance or copayments. Before getting one of these plans, consider your ability to handle the additional paperwork that is involved with them. It’s important to know that Medicare rules don’t allow you to move to a more comprehensive plan from a less comprehensive one without going through medical underwriting. You can only move from more comprehensive to less comprehensive coverage without a thorough review of your medical record.

Part D Prescription Drug Plan

The last thing you need to have comprehensive coverage is a Medicare Prescription Drug plan. The Find a Plan section of www.Medicare.gov allows you to enter your medications and choose the plan that covers your medications at the lowest annual cost, either through mail order or at retail. At Denise Lombard Insurance Service, we can help you with everything you need to follow this path. Denise will help you choose the most appropriate Medicare Supplement and Part D Prescription Drug plans.

The second path people choose to get comprehensive medical coverage is:

Path two: Medicare Advantage plans

Making a choice between path one and path two: key criteria to consider

Making a choice between path one and path two: key criteria to consider